1099-NEC vs. 1099-MISC: What’s the Difference?

September 25, 2025

Tax season is often confusing for small business owners and independent contractors alike. Recently, it got even more so as the IRS changed the rules on 1099 forms in 2020. The reintroduction of the 1099-NEC form has created some confusion, and using the wrong form on your filings can lead to IRS penalties.

Tax season is confusing, but we’re here to make it a bit easier for you when it comes to 1099s. This guide clarifies the distinction between the 1099-NEC vs. 1099-MISC, detailing their primary uses, reporting requirements, and why they’ve been separated.

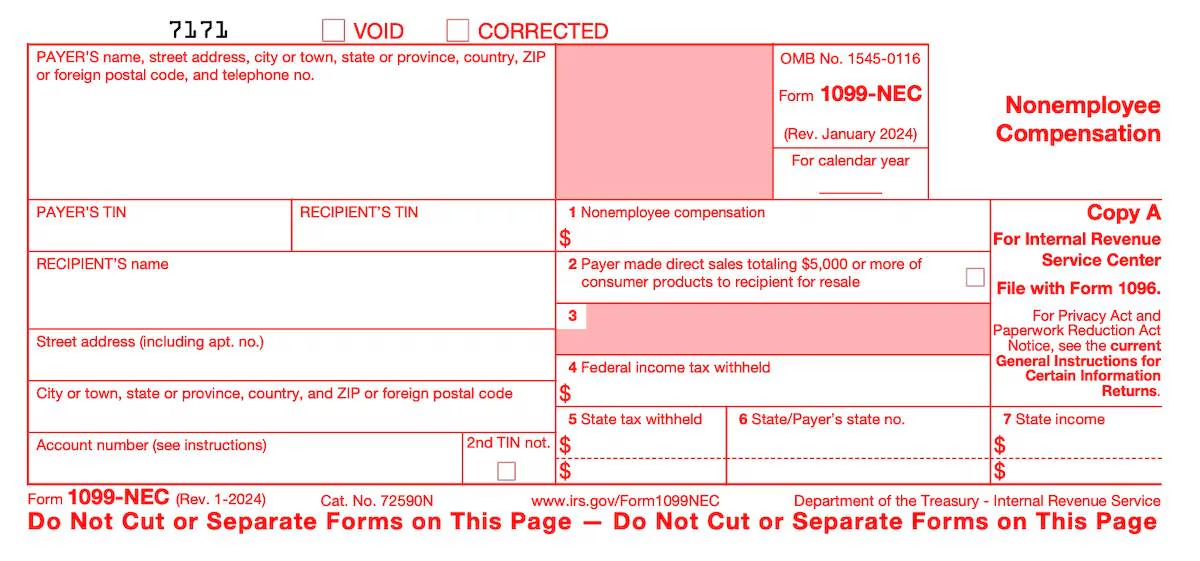

What Is a 1099-NEC Form?

The Form 1099-NEC is used to report payments of nonemployee compensation. That includes:

- Independent contractors

- Freelancers

- Gig workers

- Any other service providers who are not considered employees

While the addition of a form may seem more confusing, the IRS actually brought back the 1099-NEC form to simplify things. Essentially, if you paid an individual or a sole proprietor $600 or more for services during the tax year, you need to issue them a 1099-NEC. It’s the form all small businesses should use to pay non-employee workers.

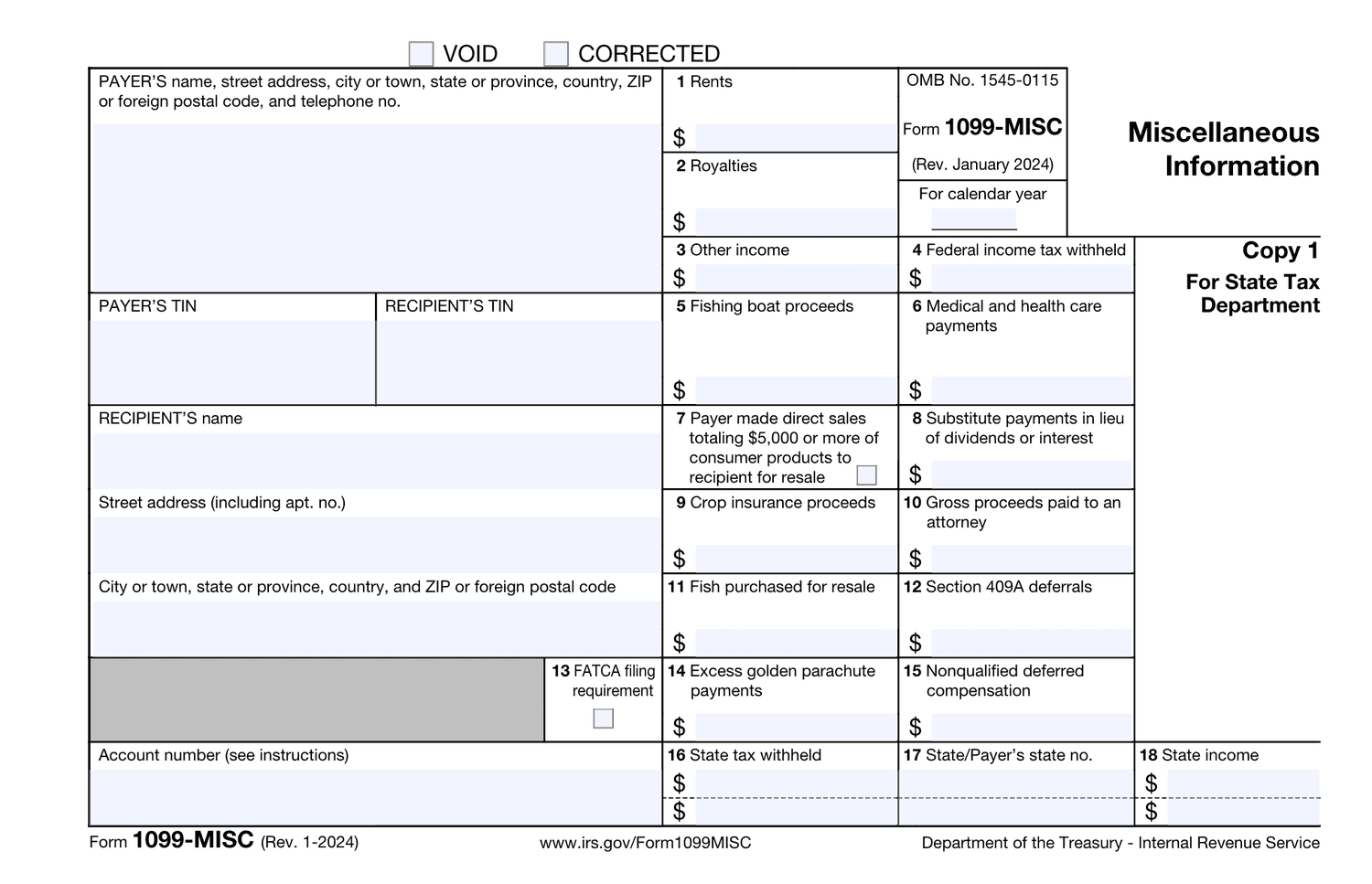

What Is a 1099-MISC Form?

The Form 1099-MISC is a much broader form used to report various types of taxable income. It used to include nonemployee compensation, but the IRS adjusted the rules to draw a clear line between work income and other types of income. Today, the 1099-MISC is used for reporting incomes such as:

- Rent payments

- Royalties

- Prizes

- Awards

- Payments to attorneys

Like the 1099-NEC, the general reporting threshold is $600 or more.

What’s the Difference Between 1099-NEC and 1099-MISC?

There are a few key distinctions between 1099-NEC and 1099-MISC.

Primary Purpose

The most important distinction is the purpose of each form. The 1099-NEC has a single, focused purpose: to report income paid to independent contractors. The 1099-MISC is more general-purpose, designed to capture all other miscellaneous income that isn’t related to services provided by a contractor.

Reporting Fields and Boxes

The two forms look a bit different. On the 1099-NEC, there is a dedicated field (Box 1) for nonemployee compensation, making it simple and straightforward. The 1099-MISC, however, uses different boxes for different types of income. For example, Box 1 is for rents, Box 3 is for other income, and so on.

Filing Deadlines

The last key difference is the filing deadline for each. The 1099-NEC has a consistent (and important) deadline of January 31st for both the recipient and the IRS, which is faster than the deadline for some 1099-MISC forms. That means you need to send them to recipients by that date.

Differences Summarized

| Feature | 1099-NEC (Nonemployee Compensation) | 1099-MISC (Miscellaneous Income) |

|---|---|---|

| Primary Purpose | Solely for payments for services rendered by a contractor | For a wide range of other miscellaneous payments |

| Reporting Fields | Uses Box 1 for Nonemployee Compensation | Reports different types of income in various boxes (e.g. Box 1 for Rents) |

| Filing Deadline | Jan. 31 for both the recipient and the IRS | Varies based on the type of payment and filing method |

Why Did 1099 Forms Change?

Before 2020, nonemployee compensation was reported in Box 7 of the 1099-MISC. However, the filing deadline for nonemployee compensation was January 31, while the deadline for other miscellaneous income on the same form was still a few months later. Confusing, right?

In 2020, the IRS brought back the 1099-NEC to help simplify the form and support fraud and tax evasion prevention efforts. With the two forms, there’s now a single, clear deadline for contractor income and other types of income, streamlining the process for everyone.

Who Should Use Which Form?

So, which one do you use?

- Use a 1099-NEC If: You’re a business owner and you paid an individual for services as a nonemployee. This includes payments to freelance graphic designers, independent web developers, plumbers, or any other type of independent contractor.

- Use a 1099-MISC If: You’re a business owner and you paid rent to a landlord, provided an award or prize, or paid an attorney for legal services.

If you’re a solopreneur or independent contractor, you may receive both forms. Just include them in your tax filings as normal, there’s nothing distinct you need to do for either form.

FAQs

Nonemployee compensation is any payment you make for services performed by someone who is not your employee. This includes freelancers, independent contractors, or sole proprietors.

If you used the wrong form, you might need to file a corrected form with both the recipient and the IRS. The IRS can impose penalties for incorrect or late filings, so it’s best to correct the error as soon as you discover it.

In most cases, you don’t need to issue a 1099-NEC to a corporation. There are some exceptions, like payments to an attorney or a healthcare provider, but for general business services, payments to corporations are exempt from this requirement.

Take a look at our news on Operations & Management

by Shanel Pouatcha

by Shanel Pouatcha

by Nick Perry

by Nick Perry

by Nick Perry

by Nick Perry

by Nick Perry

by Nick Perry

by Nick Perry

by Nick Perry

by Shanel Pouatcha

by Shanel Pouatcha

by Nick Perry

by Nick Perry

by Shanel Pouatcha

by Shanel Pouatcha

by Shanel Pouatcha

by Shanel Pouatcha

by Sandra Robins

by Sandra Robins

by Nick Perry

by Nick Perry